Revolution of Blockchain in Maritime & Container Shipping Sector

Bitcoin, often known as crypto or electronic money, is based on Blockchain Technology, which we have heard a lot about recently. As blockchain technology (cryptocurrencies) matures, it has its fair share of proponents and skeptics, but the marine sector is swiftly adopting it due to its shown potential to reduce expenses.

Tradelens and GSBN created a big revolution in the container shipping trade. Blockchain technology transformed the whole shipping world forever. Daniel Wilson, Director of Business Development at Tradelens, says: “Shipping is a slow and age-old sector currently performed in large part by phone and email, containerization was probably the last true change to the industry.” and he was right.

More than 40 port and terminal operators, as well as customs agencies, brokers, cargo owners, freight forwarders, transportation, and logistics companies, and others, are currently part of the TradeLens ecosystem. Multiple trading partners can cooperate on a single shared view of a transaction using the TradeLens platform without sacrificing specifics, privacy, or secrecy. Consider it cloud-based shipping, where each transaction is electronically sealed and stamped.

Beginning of Blockchain in Container Shipping: Group Blockchain Initiatives

Since 2017, blockchain use cases in the maritime industry have been gradually developed and tested. These cases are divided into four categories: electronic bills of lading, ship operations, ship finance, and marine insurance. The systems we’ll look at in this article are expected to include these four structures in the near future. There have been many blockchain initiatives in the Maritime & container shipping industry since 2017.

Maersk Line, one of the world’s largest maritime transport operators, has begun to use blockchain infrastructure as part of a strategic partnership with IBM in order to save time and money in the operation of ships and cargoes (containers) in international waters, as well as to speed up the process and eliminate document procedures.

A joint venture between Maersk and IBM that was launched in January 2018 and has since been chastised for alienating much-needed potential partners due to Maersk’s significant involvement. The foundation of TradeLens is its global supply-chain ecosystem made up of ocean carriers, freight forwarders, ports and terminals, shippers, Cargo owners, intermodal operators, financial services providers, customs, government authorities, brokers and more.

Tradelens blockchain model was accepted by %90 of sector

In order to discuss the problem and establish the orchestra, Maersk, CMA CGM, Hapag-Lloyd, MSC and ONE came together to evaluate the technological infrastructure and tried to establish a common manager. Years passed and 90 percent of the world joined to Tradelens finally also GSBN is well positioned in Asia. They work as integrated each other for now. On October 15, 2020, CMA CGM and MSC announced that they are fully integrated into Tradelens with their subsidiaries and subsidiaries. As a structure similar to GSBN Tradelens, it will continue to close an important gap in the sector. GSBN generally co-existed with COSCO, Shanghai International Port Group (SIPG) and Tesla. The GSBN blockchain platform, which CargoSmart has configured using the Oracle cloud platform, will continue to serve worldwide and will continue to exist in the industry as an integrated/alternative to Tradelens.

GSBN highlighted clear parallels with TradeLens. Some shipping lines and four terminal operators took a move in this direction in November 6, 2018. Various startups used infrastructures such as Ethereum, HyperLedger, R3, Corda. Firms created a coalition to develop a blockchain platform in order to digitize the sector and transform documentation processes. Global Shipping Business Network is the name of the consortium (GSBN). CMA CGM, COSCO/OOCL, and Evergreen are Ocean Alliance members, as are Yang Ming, DP World, Hutchison Ports, PSA, and Shanghai International Port. Cargo Smart was the technology firm. The reason for the difficulty is to prevent the creation of a monopoly in the sector. Therefore, the growth of the blockchain industry in shipping will be slow for the next 10 years. However, it should be known that eventually technology will dominate and maritime brands will have to agree to merge on a common platform. However, time will tell all the details and the result, of course.

According to the group plan, the GSBN would digitize papers and processes for shippers of “hazardous commodities,” which are defined as dangerous and subject to a variety of regulatory schemes, and all operations will be automated. The ultimate goal, according to CMA CGM, is to “enable the seamless sharing of papers and data at all phases of the transportation lifecycle.”

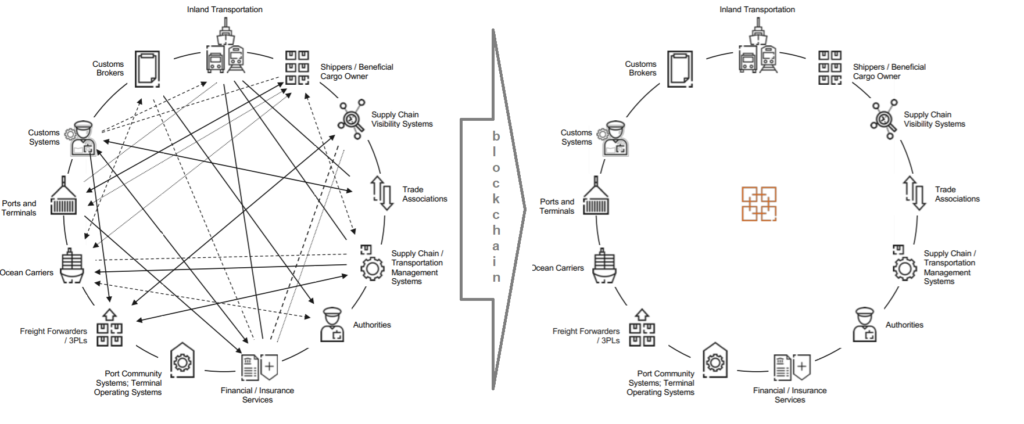

By generating a single shared view of a transaction while retaining confidentiality, TradeLens and GSBN allow trade partners to collaborate. Shippers, shipping lines, freight forwarders, port and terminal operators, inland transporters, and customs authorities may all access real-time shipping data and documents.

Similar questions arose in the industry as a result of the new collaboration. For example, how will personal information be handled? What procedures will the platform support? Will it be expanded to include other services? Will there be vendor lock-in by default, or will firms be able to harvest and process private data in their own way?

Industry experts point out that a small group control of these initiatives aimed at providing an industry platform is a big problem. Experts argue that it is not good to have to make a choice, systems must be interconnected. Thus, the sector can reach the maximum benefit as a whole.

Other maritime blockchain initiatives

Other blockchain players in the industry are added every year. You can see the table below showing the memberships created through the announcements made by Ocean carriers and platforms through the announcement channels.

Umut ARICAN